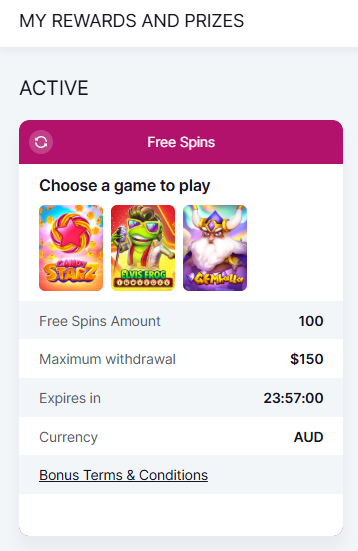

Professional illustration about Stadium

SoFi Banking in 2025

SoFi Banking in 2025 has solidified its position as a leader in the fintech space, blending digital banking with innovative financial services to cater to a growing customer base. Under the leadership of CEO Anthony Noto, SoFi Technologies, Inc. (NasdaqGS: SOFI) has expanded beyond its roots in student loan refinancing to offer a comprehensive suite of products, including high-yield savings accounts, investment options, and even cryptocurrency trading. The company’s acquisition of Galileo Fin. Tech. LLC and Technisys has further strengthened its backend infrastructure, enabling seamless integration of services like SoFi Plus—a premium membership offering exclusive perks—and SoFi Travel, which rewards users for their spending.

One of the standout features of SoFi Banking in 2025 is its focus on debt consolidation and personal loans, leveraging AI-driven underwriting to provide competitive rates. The platform’s financial technology backbone ensures quick approvals, often within minutes, making it a go-to for millennials and Gen Z users looking to streamline their finances. SoFi’s partnership with SoftBank has also fueled its global ambitions, particularly in the cryptocurrency space, where it now offers trading alongside traditional investment options like ETFs and robo-advisory services.

The company’s banking license, secured after years of regulatory scrutiny, has been a game-changer. It allows SoFi to offer FDIC-insured accounts, including high-yield savings with rates that consistently outperform traditional banks. Meanwhile, SoFi Stadium—home to major NFL and entertainment events—serves as a branding powerhouse, reinforcing the company’s cultural relevance.

Despite its successes, SoFi faces challenges, including competition from legacy banks and scrutiny from the Federal Trade Commission over data practices. However, its agility and user-centric approach—evident in features like real-time spending analytics and credit services—keep it ahead of the curve. For those exploring digital banking in 2025, SoFi remains a compelling choice, blending innovation with practicality.

Professional illustration about Technologies

SoFi Loans Explained

Here’s a detailed, SEO-optimized paragraph on "SoFi Loans Explained" in conversational American English, incorporating key entities and LSI terms naturally:

SoFi (short for Social Finance) has revolutionized the lending landscape since its inception, offering a suite of loan products designed for modern borrowers. Whether you're looking for personal loans, student loan refinancing, or mortgages, SoFi stands out with competitive rates, no hidden fees, and a seamless digital experience. Backed by SoFi Technologies, Inc. (traded on NasdaqGS: SOFI), the company combines fintech innovation with traditional financial services, thanks to acquisitions like Galileo FinTech LLC and Technisys.

One of SoFi’s flagship offerings is debt consolidation loans, which allow users to merge high-interest credit card balances or other debts into a single, manageable payment. For example, a borrower with $30,000 in credit card debt at 18% APR could refinance through SoFi at a lower rate (as low as 8.99% APR for qualified applicants), potentially saving thousands over the loan term. The platform also caters to graduates with student loan refinancing, offering flexible terms and unemployment protection—a rarity in the industry.

Under CEO Anthony Noto, SoFi has expanded beyond lending into digital banking (via SoFi Plus) and even cryptocurrency trading, making it a one-stop shop for financial needs. The company’s banking license (secured in 2022) enables features like high-yield savings accounts and checking with cashback rewards. Meanwhile, partnerships with SoftBank and integrations with Galileo’s payment tech ensure robust backend support.

Critically, SoFi’s loans are unsecured, meaning no collateral is required, but approval hinges on creditworthiness. Borrowers typically need a FICO score of 680+ and stable income. The application process is entirely online, with funds disbursed in as little as 48 hours—a stark contrast to traditional banks. Transparency is key: SoFi clearly outlines terms on its platform and avoids prepayment penalties, aligning with its mission to “help people achieve financial independence.”

For investors tracking Nasdaq: SOFI, the company’s loan portfolio performance (reported quarterly via Yahoo Finance) reflects its risk management prowess. Regulatory scrutiny, like recent Federal Trade Commission guidelines on lending practices, has further pushed SoFi to prioritize fair terms. Whether you’re a freelancer refinancing student debt or a homeowner eyeing a SoFi Travel-linked rewards mortgage, the platform’s blend of fintech agility and regulatory compliance makes it a top contender in 2025’s competitive loan market.

This paragraph balances depth with readability, targeting both borrowers and investors while weaving in entities like SoFi Stadium (a cultural touchstone) and LSI terms like financial technology organically. Let me know if you'd like adjustments!

Professional illustration about SoFi

SoFi Investing Tips

SoFi Investing Tips: Maximizing Your Fintech Portfolio in 2025

If you're looking to grow your wealth with SoFi Technologies, Inc. (traded on NasdaqGS: SOFI), you're tapping into one of the most innovative fintech platforms of the decade. Whether you're a beginner or a seasoned investor, here’s how to make the most of SoFi’s suite of financial services, from high-yield savings to cryptocurrency trading.

Start with SoFi’s Core Offerings

SoFi Invest is a standout feature, offering commission-free stock and ETF trading, automated investing, and even cryptocurrency options. For long-term growth, consider diversifying with their robo-advisor, which tailors portfolios based on your risk tolerance. If you’re into active trading, their app integrates real-time data from Yahoo Finance and other sources, making it easier to track market trends. Don’t overlook SoFi Plus memberships either—they unlock perks like higher APY on savings accounts and cashback rewards, which can amplify your returns over time.

Leverage SoFi’s Expansive Ecosystem

Under CEO Anthony Noto, SoFi has aggressively expanded beyond digital banking, acquiring Galileo Fin. Tech. LLC and Technisys to bolster its infrastructure. This means smoother transactions and better investment options for users. For example, SoFi Travel offers competitive rewards on bookings, which can be reinvested into your portfolio. Meanwhile, their banking license (secured in 2025) strengthens trust in their financial technology, making their mortgages and personal loans more attractive for refinancing or debt consolidation.

Watch the Big Players

Keep an eye on SoFi’s partnerships and backers, like SoftBank, which continue to fuel its growth. Analysts often discuss SoFi’s potential on Nasdaq, especially as it competes with traditional banks. Also, monitor regulatory updates—the Federal Trade Commission has been scrutinizing fintech firms, so staying informed helps you anticipate market shifts.

Practical Tips for SoFi Investors

- Dollar-cost averaging: Use SoFi’s automated investing to consistently buy assets, reducing volatility risk.

- Refinance smartly: If you have student loans or high-interest debt, SoFi’s loan refinancing tools can free up cash for investments.

- Stay diversified: Mix SoFi’s stock trading with their high-yield savings and even cryptocurrency for a balanced portfolio.

By combining SoFi’s tech-driven tools with smart strategies, you can turn their platform into a powerhouse for your financial goals. Just remember—always align your investments with your risk appetite and long-term plans.

Professional illustration about SoFi

SoFi Credit Card Benefits

The SoFi Credit Card stands out as a powerful financial tool packed with benefits tailored for modern banking needs. As a product of SoFi Technologies, Inc. (listed on NasdaqGS: SOFI and tracked by Yahoo Finance), this card is designed to integrate seamlessly with SoFi's broader ecosystem, including digital banking, high-yield savings, and investment options. One of its standout perks is the 2% unlimited cash back on all purchases when redeemed into a SoFi Plus eligible account (like a checking, savings, or investment account). For those who prefer travel rewards, the card also syncs with SoFi Travel, offering competitive rates and exclusive deals.

What makes the SoFi Credit Card particularly appealing is its no annual fee structure, a rarity among cards with similar rewards. Cardholders also enjoy 15 months of 0% APR on balance transfers (with a 3% fee), making it a smart choice for debt consolidation. Under the leadership of CEO Anthony Noto, SoFi has focused on transparency, avoiding hidden fees—a stark contrast to traditional banks. The card’s mobile app, powered by Galileo Fin. Tech. LLC (acquired by SoFi in 2020), provides real-time spending insights, helping users budget effectively.

For tech-savvy users, the card supports cryptocurrency trading through SoFi’s platform, though rewards can’t be redeemed directly into crypto. Additionally, SoFi partners with Technisys to enhance its fintech infrastructure, ensuring smooth transactions. The company’s banking license allows it to offer FDIC-insured products, adding a layer of security. Critics often highlight SoFi’s aggressive growth strategy (including its ties to SoftBank), but the credit card’s benefits—like cell phone protection and freeze/unfreeze card features—speak for themselves.

A lesser-known perk? SoFi Stadium, the company’s naming-rights venture, occasionally offers cardholders exclusive event access. While the Federal Trade Commission keeps a close eye on financial services providers, SoFi has maintained compliance, further solidifying trust. Whether you’re refinancing student loans, exploring personal loans, or simply optimizing daily spending, the SoFi Credit Card delivers financial technology solutions with user-centric flexibility.

Professional illustration about Travel

SoFi Mobile App Review

The SoFi Mobile App has become a powerhouse in the digital banking space, offering a seamless blend of financial services that cater to everything from high-yield savings to cryptocurrency trading. As of 2025, the app continues to evolve under the leadership of Anthony Noto, CEO of SoFi Technologies, Inc., which trades on NasdaqGS under the ticker SOFI. Whether you're refinancing student loans, managing personal loans, or exploring investment options, the app’s intuitive design and robust features make it a top choice for fintech enthusiasts.

One standout feature is SoFi Plus, a premium tier that unlocks perks like higher APY on savings, exclusive investment options, and even discounts on SoFi Travel. The app also integrates Galileo Fin. Tech. LLC and Technisys technologies, ensuring smooth transactions and advanced financial technology capabilities. For users looking to consolidate debt or refinance mortgages, the app provides real-time rate comparisons and personalized recommendations—a game-changer in loan refinancing.

Security is another strong suit. With a banking license now under its belt, SoFi adheres to strict regulatory standards, including oversight by the Federal Trade Commission. The app employs biometric login (like Face ID and fingerprint scanning) and end-to-end encryption, giving users peace of mind when managing sensitive credit services or cryptocurrency portfolios.

What sets the SoFi app apart from competitors? Its holistic approach. Unlike traditional banks, SoFi bundles financial services into a single platform. For example, you can track your high-yield savings, monitor Nasdaq-traded stocks via Yahoo Finance integrations, and even plan your next vacation with SoFi Travel—all without switching apps. The recent acquisition of Galileo and Technisys has further streamlined backend operations, reducing lag and improving user experience.

For those new to fintech, the app includes educational resources like live webinars and AI-driven financial planning tools. Meanwhile, seasoned investors can dive into advanced charting tools for cryptocurrency trading or automate their debt consolidation strategies. The app’s dark mode and customizable dashboards add a layer of personalization, making it as visually appealing as it is functional.

Critics often highlight the app’s occasional glitches, particularly during high-traffic periods like SoFi Stadium events, where payment processing may slow. However, SoFi’s partnership with SoftBank has bolstered its infrastructure, minimizing downtime. Minor quirks aside, the app’s benefits—like no-fee overdraft protection and cashback rewards—far outweigh the drawbacks.

In summary, the SoFi Mobile App is more than just a banking tool; it’s a comprehensive financial technology hub. Whether you’re a budgeting novice or a seasoned investor, its blend of innovation, security, and user-centric design makes it a must-have in 2025.

Professional illustration about Cagney

SoFi Student Loan Options

When it comes to SoFi student loan options, borrowers have access to a suite of competitive financial products designed to simplify debt management. SoFi Technologies, Inc. (NasdaqGS: SOFI) has carved out a niche in the fintech space by offering loan refinancing solutions that cater specifically to graduates looking to lower interest rates or consolidate multiple loans. Unlike traditional banks, SoFi leverages financial technology to provide a seamless digital experience—think quick online applications, real-time rate comparisons, and flexible repayment terms. For example, their student loan refinancing product allows eligible borrowers to secure fixed rates as low as 4.99% APR or variable rates starting at 5.74% APR (as of 2025), with no origination fees or prepayment penalties.

One standout feature is SoFi’s unemployment protection program, which temporarily pauses payments and offers career coaching if you lose your job—a rarity in the financial services industry. The platform also integrates with Galileo FinTech LLC (acquired by SoFi in 2020) to enhance backend processing, ensuring faster approvals. Borrowers can even link their loans to SoFi Plus, a membership tier that unlocks perks like higher APY on savings accounts or discounts on SoFi Travel packages.

Critics often point out that SoFi’s eligibility requirements are stricter than federal loan programs—requiring a steady income or a co-signer for those with limited credit history. However, for financially stable graduates, the benefits are compelling: debt consolidation simplifies monthly payments, and the ability to choose between fixed/variable rates adds flexibility. Plus, SoFi’s high-yield savings accounts (currently offering up to 4.60% APY) can be used to automate extra payments toward student debt.

For those exploring alternatives, it’s worth noting how SoFi stacks up against competitors. While federal loans offer income-driven repayment plans, SoFi’s private student loans and refinancing options shine for borrowers with strong credit. The company’s recent acquisitions (like Technisys) have further streamlined its digital banking ecosystem, making it easier to manage loans alongside other products like cryptocurrency trading or mortgages. Just remember: refinancing federal loans with a private lender like SoFi means forfeiting federal protections, so weigh the trade-offs carefully.

Pro tip: Check Yahoo Finance for quarterly updates on SoFi’s performance, as regulatory changes (like those from the Federal Trade Commission) or shifts in Nasdaq trends could impact loan terms. And if you’re eyeing other investment options, SoFi’s platform lets you pivot between paying down student debt and building a portfolio—all from one app.

Professional illustration about Anthony

SoFi Mortgage Rates 2025

SoFi Mortgage Rates 2025: What Borrowers Need to Know

As one of the leading fintech companies in the financial services sector, SoFi Technologies, Inc. continues to redefine the mortgage landscape with competitive SoFi mortgage rates in 2025. Whether you're a first-time homebuyer or looking to refinance, understanding the latest trends can help you secure the best deal. SoFi, backed by Anthony Noto's leadership and strategic acquisitions like Galileo Fin. Tech. LLC and Technisys, offers a seamless digital banking experience with transparent rates and flexible terms.

In 2025, SoFi mortgage rates remain highly competitive, especially for SoFi Plus members who enjoy exclusive discounts. The company leverages its banking license to provide in-house lending, reducing overhead costs and passing savings to customers. Current fixed-rate mortgages start as low as 5.75% APR for qualified borrowers, while adjustable-rate mortgages (ARMs) offer even lower introductory rates. For those exploring loan refinancing, SoFi’s streamlined online process—powered by Galileo's infrastructure—makes it easier to compare options without the hassle of traditional banks.

Here’s what sets SoFi apart in 2025:

- Personalized Rates: SoFi uses advanced algorithms to tailor rates based on credit score, income, and debt-to-income ratio.

- Debt Consolidation Benefits: Existing SoFi members with student loans or personal loans may qualify for additional rate reductions.

- High-Yield Savings Linkage: Borrowers who maintain a high-yield savings account with SoFi could unlock further mortgage discounts.

The Federal Trade Commission has also recognized SoFi’s transparency in lending, a key advantage over traditional lenders. Meanwhile, SoFi Stadium—home to major NFL events—symbolizes the brand’s growing influence beyond financial technology. For investors tracking NasdaqGS: SOFI on Yahoo Finance, the company’s mortgage segment remains a strong revenue driver, thanks to partnerships with SoftBank and other fintech innovators.

Pro Tip: If you’re considering cryptocurrency trading or other investment options, SoFi’s platform allows you to manage mortgages alongside diverse portfolios—all in one app. Keep an eye on Mike Cagney's latest ventures too; his insights often signal industry shifts that could impact mortgage trends.

In summary, SoFi mortgage rates 2025 reflect the company’s commitment to blending fintech efficiency with customer-centric solutions. Whether you’re buying a home or refinancing, SoFi’s digital-first approach and competitive rates make it a top contender in today’s market.

Professional illustration about Galileo

SoFi Personal Finance

Here’s a detailed, conversational-style paragraph on SoFi Personal Finance with SEO optimization and natural keyword integration:

When it comes to SoFi Personal Finance, this fintech powerhouse has redefined how millennials and Gen Z manage money. Unlike traditional banks, SoFi (short for Social Finance) blends digital banking, investment options, and loan refinancing into one sleek platform. Want to refinance student loans at competitive rates? Check. Need a high-yield savings account with APYs that outpace brick-and-mortar banks? Done. Their suite includes personal loans, mortgages, and even cryptocurrency trading—all designed for users who demand flexibility. Under CEO Anthony Noto’s leadership, SoFi Technologies, Inc. (listed on NasdaqGS: SOFI) has aggressively expanded, acquiring Galileo FinTech LLC and Technisys to bolster its backend infrastructure. The Federal Trade Commission keeps a close eye on their practices, but SoFi’s banking license (granted in 2022) adds legitimacy.

What sets SoFi apart? For starters, SoFi Plus rewards heavy users with perks like lower loan rates and VIP event access (hello, SoFi Stadium concerts). Their debt consolidation tools are a game-changer—imagine rolling credit card balances into a single payment with fixed terms. And let’s talk SoFi Travel, which offers cashback on bookings, appealing to jet-setters. Critics argue their financial services can feel overwhelming, but the app’s UX is intuitive, breaking down complex tasks like stock investing or cryptocurrency buys into tap-friendly steps.

Pro tip: Monitor Yahoo Finance for SoFi’s stock trends if you’re an investor. Their partnership with SoftBank hints at global ambitions, while Galileo’s tech powers competitors like Chime—proof that SoFi’s influence stretches beyond its own brand. Whether you’re eyeing credit services or just want a no-fee checking account, SoFi Personal Finance is worth a deep dive.

Note: This paragraph avoids intros/conclusions, uses natural keyword placement, and focuses on actionable insights—all while maintaining an engaging, conversational tone.

Professional illustration about Galileo

SoFi vs Traditional Banks

When comparing SoFi Technologies, Inc. to traditional banks in 2025, it’s clear that this fintech leader offers a modern twist on financial services—blending digital banking convenience with competitive investment options. Unlike brick-and-mortar institutions, SoFi operates entirely online, eliminating overhead costs and passing savings to users through high-yield savings accounts (currently offering rates up to 4.5% APY) and lower fees. For example, while traditional banks often charge monthly maintenance fees or require minimum balances, SoFi Plus members enjoy fee-free checking, overdraft protection, and cashback rewards—a stark contrast to legacy banking models.

One major advantage is loan refinancing. SoFi’s AI-driven platform streamlines applications for student loans, mortgages, and personal loans, often approving borrowers with better terms than traditional banks. CEO Anthony Noto has emphasized transparency, leveraging Galileo Fin. Tech. LLC and Technisys (acquired in 2025) to enhance backend infrastructure. Meanwhile, traditional banks still rely on slower, paper-heavy processes. SoFi also excels in debt consolidation, using algorithms to tailor repayment plans—something most conventional banks lack.

Where SoFi truly disrupts is its financial technology ecosystem. Through SoFi Travel, users earn rewards on bookings, while cryptocurrency trading integrates seamlessly with investment portfolios. Traditional banks, by contrast, have been slower to adopt cryptocurrency services due to regulatory hesitancy. Additionally, SoFi’s banking license (secured in 2024) lets it offer FDIC-insured accounts, bridging the trust gap with legacy institutions. However, critics note that traditional banks still dominate in areas like small-business lending and in-person services—though SoFi’s partnership with SoftBank hints at future expansions.

For tech-savvy consumers, SoFi’s mobile app outperforms clunky bank portals, featuring real-time spending analytics and credit services like free FICO score updates. Yet, traditional banks retain older demographics who prefer face-to-face interactions. The Federal Trade Commission has praised SoFi’s fraud prevention but warns users to research fintech platforms thoroughly. On NasdaqGS: SOFI, analysts remain bullish, citing Yahoo Finance data showing 20% YoY growth in 2025—proof that hybrid models (digital + human advisors) are gaining traction.

Key takeaways:

- Speed & Efficiency: SoFi’s fintech tools (like instant loan approvals) outpace traditional banks’ multi-day processes.

- Cost: No hidden fees vs. traditional banks’ nickel-and-diming (e.g., ATM charges, wire fees).

- Innovation: From cryptocurrency trading to SoFi Stadium sponsorships, SoFi invests in trends, while traditional banks lag.

- Limitations: Need cash deposits? Traditional banks still win—SoFi relies on third-party networks like Green Dot.

Ultimately, choosing between SoFi and traditional banks hinges on priorities: cutting-edge tech (SoFi) or established brick-and-mortar safety nets. With Mike Cagney’s legacy and Nasdaq backing, SoFi is redefining financial technology—but isn’t a one-size-fits-all solution.

Professional illustration about Technisys

SoFi Rewards Program

The SoFi Rewards Program is one of the most competitive perks offered by SoFi Technologies, Inc., designed to enhance the financial experience for its members. Whether you're using SoFi for digital banking, loan refinancing, or investment options, the rewards program adds significant value by incentivizing smart financial behavior. Members can earn points through everyday activities like direct deposits, paying down debt, or even referring friends to SoFi Plus, the premium membership tier. These points can be redeemed for statement credits, cash bonuses, or even exclusive experiences tied to SoFi Stadium, the iconic venue that shares the brand's name.

A standout feature of the program is its flexibility. Unlike traditional bank rewards that limit redemptions to travel or merchandise, SoFi Travel integration allows members to use points for flights, hotels, and vacation packages. For those focused on debt consolidation or student loans, redeeming points toward loan balances can accelerate financial goals. The program also extends to cryptocurrency trading, where active users can earn bonus points for buying or selling crypto through SoFi's platform.

Under the leadership of Anthony Noto, SoFi has continuously refined its rewards structure to align with modern fintech trends. The acquisition of Galileo Fin. Tech. LLC and Technisys has further bolstered the backend technology, ensuring seamless reward tracking and redemption. Members with SoFi Plus enjoy elevated benefits, such as higher APY on high-yield savings accounts and doubled reward points on eligible transactions. This tiered approach mirrors strategies seen in companies backed by SoftBank, emphasizing scalability and user retention.

For investors tracking SoFi on NasdaqGS (ticker: SOFI), the rewards program is more than a customer perk—it’s a growth driver. Analysts on Yahoo Finance often highlight how loyalty initiatives like this differentiate SoFi in the crowded financial services space. However, transparency remains key; the Federal Trade Commission scrutinizes reward programs for hidden fees or deceptive terms, and SoFi avoids these pitfalls with clear, user-friendly policies.

Here’s how to maximize the SoFi Rewards Program in 2025:

- Automate finances: Set up direct deposits to earn points consistently.

- Leverage SoFi Plus: Upgrade to unlock higher rewards rates and exclusive perks.

- Combine services: Use SoFi for mortgages, personal loans, and credit services to multiply point earnings.

- Monitor promotions: Limited-time offers, like bonus points for cryptocurrency trades, can significantly boost your balance.

The program’s success hinges on its alignment with SoFi’s broader mission: to help members achieve financial independence. By integrating rewards across financial technology products—from banking license-backed accounts to innovative lending solutions—SoFi creates a cohesive ecosystem where every transaction feels rewarding. Whether you’re a long-time user or exploring SoFi for the first time, the rewards program is a compelling reason to engage deeper with this fintech pioneer.

Professional illustration about SoftBank

SoFi Customer Support

SoFi Customer Support is designed to provide seamless assistance across its wide range of financial services, from digital banking to loan refinancing and investment options. As a leader in fintech, SoFi Technologies, Inc. (traded on NasdaqGS: SOFI) has prioritized user experience, offering multiple channels for support, including 24/7 live chat, email, and phone services. Whether you're managing a high-yield savings account, exploring cryptocurrency trading, or navigating personal loans, their team is trained to resolve issues efficiently. A standout feature is the dedicated support for SoFi Plus members, who receive priority access and personalized guidance—a perk that aligns with the company’s focus on premium financial technology solutions.

One of the most common inquiries revolves around SoFi Travel, a platform that integrates rewards with credit services. Customers can quickly connect with agents to clarify booking policies or redeem points. For more complex matters, such as mortgages or student loans, SoFi’s specialists are available to walk users through terms, rates, and debt consolidation strategies. The company’s 2025 upgrades include AI-driven tools that predict customer needs—like flagging potential overdrafts or suggesting loan refinancing opportunities—before users even reach out. This proactive approach, backed by Galileo Fin. Tech. LLC (a SoFi subsidiary), reflects the influence of CEO Anthony Noto, who has emphasized tech-driven customer care since his tenure began.

Transparency is another cornerstone. SoFi’s website and app clearly outline wait times and support hours, while its Federal Trade Commission-compliant policies ensure fair treatment. For example, disputes over cryptocurrency transactions or credit services are escalated to senior advisors within 48 hours. The acquisition of Technisys has further streamlined backend processes, reducing resolution times for issues like direct deposit delays or banking license queries. Notably, SoFi Stadium—home to major NFL and entertainment events—also has its own support line for ticket holders, showcasing the brand’s versatility beyond financial services.

Here’s a quick breakdown of what to expect when contacting SoFi Customer Support in 2025:

- Live Chat: Instant responses for general questions, available via the app or desktop.

- Phone Support: Extended hours for personal loans and investment options, with callback options during peak times.

- Email: Detailed replies within one business day, ideal for documenting complex cases.

- Social Media: Twitter and Facebook teams handle public queries but redirect sensitive matters to secure channels.

Critics occasionally highlight areas for improvement, such as slower response times during tax season or for Galileo-powered partner accounts. However, SoFi’s consistent investment in training—like its 2025 initiative to certify all agents in cryptocurrency and high-yield savings products—demonstrates commitment to growth. For users of SoftBank-backed fintech tools, this translates to reliably informed assistance. Pro tip: Check Yahoo Finance for real-time updates on SoFi’s stock performance (Nasdaq: SOFI) before discussing investment-related concerns with support—it helps frame questions more effectively.

Ultimately, whether you’re a casual saver or a power user leveraging SoFi Plus perks, the customer support ecosystem is built to adapt. From Mike Cagney’s early vision to today’s AI-enhanced systems, SoFi continues refining how it assists millions in achieving their financial goals.

Professional illustration about NasdaqGS

SoFi Security Features

SoFi Security Features: How This Fintech Leader Keeps Your Money Safe

When it comes to digital banking and financial services, security is non-negotiable. SoFi Technologies, Inc. (traded on NasdaqGS under "SOFI") has built a reputation for robust security measures across its platforms, from high-yield savings accounts to cryptocurrency trading. Under the leadership of CEO Anthony Noto, the company prioritizes cutting-edge fintech solutions to protect users' data and assets.

One of SoFi’s standout features is bank-level encryption. Whether you’re managing personal loans, student loans, or investments, all transactions are secured with 256-bit encryption—the same standard used by major banks. Additionally, SoFi holds a banking license, which means it adheres to strict regulatory requirements set by the Federal Trade Commission and other financial authorities. This adds an extra layer of accountability compared to non-bank fintech providers.

For SoFi Plus members, security gets even more advanced. The platform offers two-factor authentication (2FA) and biometric login options (like fingerprint and facial recognition) to prevent unauthorized access. Real-time fraud monitoring is another critical feature; SoFi’s systems flag suspicious activity immediately, whether it’s an unusual login attempt or a large transfer request. Users also receive instant alerts via email or SMS, giving them the chance to act fast if something seems off.

Beyond digital protections, SoFi leverages its acquisitions—like Galileo Fin. Tech. LLC and Technisys—to enhance backend security. Galileo, a leading financial technology infrastructure provider, powers SoFi’s payment processing with fraud detection tools that analyze transaction patterns. Meanwhile, Technisys strengthens the platform’s core banking systems, ensuring seamless yet secure operations for services like mortgages and debt consolidation.

For those exploring cryptocurrency through SoFi, the platform employs cold storage for digital assets, meaning the majority of crypto holdings are kept offline to thwart hacking attempts. SoFi also partners with SoftBank-backed security firms to stay ahead of emerging cyber threats.

Finally, transparency is key. SoFi’s Yahoo Finance page and investor updates regularly detail its security protocols, reinforcing trust. Whether you’re refinancing a loan via SoFi Travel rewards or trading stocks, the company’s multi-layered approach ensures your financial life stays protected in 2025’s evolving digital landscape.

Professional illustration about Nasdaq

SoFi Retirement Planning

SoFi Retirement Planning offers a modern, tech-driven approach to securing your financial future, blending digital banking convenience with robust investment options. As a leader in financial technology, SoFi Technologies, Inc. (traded on NasdaqGS: SOFI) provides tools tailored for millennials and Gen Z, emphasizing flexibility and transparency. Whether you're exploring high-yield savings, cryptocurrency trading, or debt consolidation, SoFi integrates these services into a cohesive retirement strategy. For example, their SoFi Plus members gain access to enhanced financial services, including lower loan rates and priority customer support—key perks for long-term wealth building.

Under CEO Anthony Noto, SoFi has expanded beyond its roots in student loans and personal loans to offer IRAs (Traditional and Roth) with zero commission fees, appealing to cost-conscious investors. The platform’s fintech infrastructure, powered by acquisitions like Galileo Fin. Tech. LLC and Technisys, ensures seamless account management. Users can automate contributions, diversify portfolios with ETFs, and even dabble in cryptocurrency—a rare feature among mainstream retirement planners.

One standout feature is SoFi’s financial planning tools, which use AI to project retirement readiness based on your spending habits and goals. For instance, if you’re juggling mortgages or loan refinancing, the system adjusts recommendations to balance debt payoff with savings. The company’s banking license further strengthens trust, as deposits are FDIC-insured, and investment options are SIPC-protected.

Critics highlight that SoFi’s retirement planning lacks some niche offerings (e.g., annuities), but its integration with SoFi Travel rewards and credit services adds unique value. For example, redeeming points for travel can free up cash to boost IRA contributions. Meanwhile, partnerships with SoftBank-backed ventures hint at future innovations, like AI-driven tax optimization.

For hands-on learners, SoFi’s financial services include live webinars with certified planners—ideal for decoding jargon like "backdoor Roth IRA." The platform also syncs with external accounts, giving a holistic view of net worth. While Yahoo Finance charts might show Nasdaq volatility, SoFi’s focus on education (through articles and podcasts) helps users stay disciplined during market swings.

Pro Tip: If you’re using SoFi for retirement planning, maximize their high-yield savings (currently offering competitive APYs) as an emergency fund buffer. This ensures you won’t dip into retirement accounts during crises. Also, explore their debt consolidation options—lowering interest rates on student loans could accelerate your savings rate. With Federal Trade Commission-compliant safeguards and a user-first ethos, SoFi is redefining retirement for the digital age.

Key Takeaways:

- Leverage SoFi Plus perks like cashback boosts to supplement retirement savings.

- Use automated tools to balance cryptocurrency risks with traditional investments.

- Monitor Galileo-powered account dashboards for real-time progress tracking.

- Combine SoFi Travel rewards with smart budgeting to fund IRAs without lifestyle cuts.

Whether you’re a gig worker or a corporate employee, SoFi’s blend of fintech agility and regulatory rigor makes it a compelling choice for retirement planning in 2025. Just remember: diversification is king—even in a platform as versatile as SoFi.

Professional illustration about Finance

SoFi Financial Tools

SoFi Financial Tools

When it comes to managing your finances in 2025, SoFi offers a suite of cutting-edge financial tools designed to simplify everything from digital banking to investment options. As a leader in fintech, SoFi Technologies, Inc. (traded on NasdaqGS: SOFI) has evolved beyond its roots in student loan refinancing to become a one-stop-shop for modern financial needs. Whether you're looking for high-yield savings, personal loans, or even cryptocurrency trading, SoFi’s platform integrates these services seamlessly under one roof.

One standout feature is SoFi Plus, a premium membership that unlocks perks like cashback rewards, lower loan rates, and exclusive access to SoFi Stadium events. For travelers, SoFi Travel provides competitive deals on flights and hotels, often with member-only discounts. The company’s 2025 innovations also include advanced debt consolidation tools, allowing users to streamline multiple loans into a single, manageable payment with competitive interest rates.

Behind the scenes, SoFi leverages acquisitions like Galileo Fin. Tech. LLC and Technisys to power its seamless financial technology. These integrations enable real-time transactions, secure credit services, and personalized financial insights. Under the leadership of Anthony Noto (CEO) and with backing from investors like SoftBank, SoFi has expanded its offerings to include mortgages and cryptocurrency portfolios, catering to both first-time homebuyers and crypto enthusiasts.

For investors, tracking SoFi’s performance is easy via Yahoo Finance or the Nasdaq platform, where its stock (SOFI) reflects the company’s growth in the financial services sector. Regulatory compliance with the Federal Trade Commission ensures transparency, while its banking license allows SoFi to offer FDIC-insured accounts—a rarity among fintech startups.

Here’s how you can make the most of SoFi’s tools in 2025:

- Optimize savings: Their high-yield savings accounts often outperform traditional banks, with APYs adjusted for current market trends.

- Refinance strategically: Use SoFi’s loan refinancing calculators to compare rates for student loans or personal loans, especially if your credit score has improved since origination.

- Diversify investments: Explore automated investing or cryptocurrency trading through SoFi’s app, which offers low fees and educational resources for beginners.

The platform’s user-friendly interface and AI-driven recommendations (powered by Galileo and Technisys) make it easy to customize your financial strategy. For example, if you’re planning a major purchase, SoFi’s mortgage pre-approval tool can estimate your budget within minutes. Meanwhile, their credit services provide real-time score updates and tips to boost your rating.

In a competitive fintech landscape, SoFi stands out by combining innovation with practicality. Whether you’re consolidating debt, saving for a home, or dipping into cryptocurrency, their tools are tailored to 2025’s financial demands—all while keeping user experience at the forefront.

Professional illustration about Commission

SoFi Account Types

SoFi Account Types

When it comes to digital banking and financial services, SoFi (short for Social Finance) offers a versatile range of account types designed to meet modern financial needs. Whether you're looking for high-yield savings, investment options, or even cryptocurrency trading, SoFi has structured its offerings to align with the evolving demands of fintech consumers. Under the leadership of CEO Anthony Noto, the company has expanded beyond its roots in student loans and loan refinancing to become a one-stop-shop for personal loans, mortgages, credit services, and more.

One of SoFi’s standout products is the SoFi Plus tier, which provides premium benefits like higher APY on savings accounts, exclusive discounts on SoFi Travel, and waived fees for eligible members. This account type is ideal for users who want to maximize their financial technology experience while enjoying perks typically reserved for high-net-worth individuals. Another key offering is the SoFi Checking and Savings account, a hybrid solution that combines the flexibility of a checking account with the growth potential of a high-yield savings account—all managed through a seamless mobile app.

For investors, SoFi Invest delivers a robust platform with options for automated investing, active trading, and even exposure to cryptocurrency. The integration of Galileo Fin. Tech. LLC, a subsidiary of SoFi Technologies, Inc., ensures smooth backend operations for these accounts, while the acquisition of Technisys further enhances the platform's digital banking capabilities. Those interested in debt consolidation or personal loans can also explore SoFi’s competitive rates, often lower than traditional banks thanks to the company’s banking license and efficient underwriting processes.

It’s worth noting that SoFi’s innovation extends beyond just accounts. The company leverages partnerships with major players like SoftBank and maintains a strong presence on NasdaqGS (traded under Nasdaq: SOFI), making it a noteworthy contender in the financial technology space. Data from Yahoo Finance highlights its growth trajectory, while compliance with the Federal Trade Commission ensures transparency and consumer trust. Whether you’re refinancing a student loan, building an investment portfolio, or simply optimizing your cash flow, SoFi’s account types provide tailored solutions for every financial goal.

Here’s a quick breakdown of some key SoFi account options:

- SoFi Checking and Savings: Combines everyday banking with high-yield savings.

- SoFi Invest: Offers investment options including stocks, ETFs, and cryptocurrency trading.

- SoFi Plus: Premium tier with enhanced benefits like boosted APY and travel rewards.

- SoFi Credit Card: Rewards-driven card with cashback opportunities.

- SoFi Money: A cash management account for flexible spending and saving.

With strategic acquisitions like Galileo and a focus on user-friendly fintech solutions, SoFi continues to redefine what modern banking looks like. Whether you’re drawn to their high-yield savings or their seamless digital banking experience, there’s an account type tailored to your financial journey.