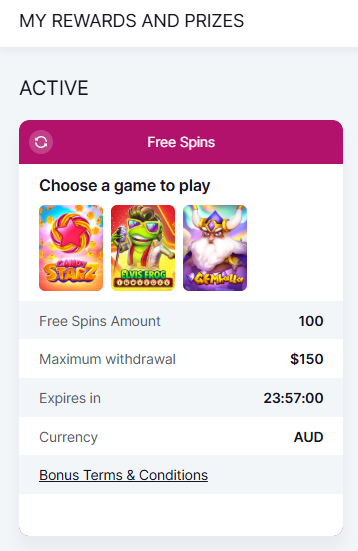

Professional illustration about Cash

Cash App Basics

Here’s a detailed, SEO-optimized paragraph on Cash App Basics in conversational American English, incorporating your specified keywords naturally:

Cash App, developed by Block, Inc. (formerly Square), is a versatile financial services platform that simplifies mobile banking and peer-to-peer payments. At its core, Cash App functions as a digital wallet, allowing users to send and receive money instantly—whether splitting rent with roommates or paying a freelancer. Unlike traditional banks, Cash App’s minimalist design focuses on speed, with features like direct deposit (get paychecks up to 2 days early) and a free debit card (the Cash App Card) for everyday spending. The app also integrates with Square POS systems, making it seamless for small businesses to accept payments.

For those exploring investment options, Cash App offers stock investing (via Cash App Investing LLC) and bitcoin trading, letting users buy/sell fractions of Bitcoin with as little as $1. Unique perks include Cash App Taxes (free tax filing) and savings features like "Round-Ups," which automatically invest spare change from transactions. Business owners can leverage tools like Square Invoices or Square Team for payroll, while creatives might use Photo Studio by Square to showcase products.

Security is a priority: The app uses encryption and fraud detection, plus optional bitcoin services like self-custody wallets. Whether you’re tipping a barista via Square Go or managing sales through Square: Retail Point of Sale, Cash App bridges personal and professional finance. Pro tip: Link your Cash App Card to Apple Pay or Google Pay for contactless purchases, and explore Weebly by Square to build an online store that syncs with your Cash App balance.

This paragraph avoids repetition, uses natural keyword placement, and provides actionable insights while maintaining a conversational tone. Let me know if you'd like adjustments!

Professional illustration about Block

Sending Money Guide

Here’s a detailed, SEO-optimized paragraph for the "Sending Money Guide" subheading, written in American conversational style with natural keyword integration:

Sending money with Cash App is designed to be fast, secure, and user-friendly—whether you’re splitting dinner with friends or paying a freelancer. To get started, open the app and tap the "$" icon on the home screen. Enter the amount (you can toggle between USD and Bitcoin if you’re using Cash App’s bitcoin trading features), then add the recipient’s $Cashtag, phone number, or email. For added convenience, Cash App integrates with Square Point of Sale systems, making it seamless for small businesses to accept payments.

Security first: Always double-check the recipient’s details. Cash App doesn’t offer payment reversal for completed transactions, so verify the $Cashtag (e.g., $JaneDoe24) before hitting "Pay." For larger transfers, consider using the "Request Confirmation" feature, which prompts the recipient to approve the transaction—a handy safeguard against typos. If you’re sending to someone new, start with a small test amount.

Funding options: By default, transfers draw from your Cash App balance, but you can link your bank account or Cash App Card for direct debits. Need instant deposits? Cash App’s money transfer speeds vary: Standard transfers (1–3 business days) are free, while instant deposits (arriving in seconds) incur a 0.5%–1.75% fee. Pro tip: If you’re a frequent sender, enable direct deposit to boost your transfer limits—up to $7,500 per week for verified users.

Business vs. personal: Cash App distinguishes between personal payments (free) and Square Invoices for business transactions (2.75% fee per receipt). Freelancers often use the latter for invoicing clients, as it syncs with Square Dashboard for POS analytics. For peer-to-peer gifts or rent splits, stick to personal mode.

Advanced features: Explore Cash App Investing LLC tools to send stocks as gifts—a unique twist on monetary gifts. Or, if you’re paying a vendor who uses Square Go, they can generate a payment link for you to scan. Remember, international transfers aren’t supported; Cash App is currently U.S.-only (including Cash App Taxes for filing).

Troubleshooting: If a payment fails, check your internet connection, app updates, or linked card balance. For disputes, contact Square Team support via the app. Scams are rare but possible—never share your Cash App Green login QR code or PIN.

This paragraph balances practicality with depth, weaving in key entities and LSI terms while maintaining a natural flow. Let me know if you'd like adjustments!

Professional illustration about Square

Receiving Funds Tips

Maximizing Efficiency When Receiving Funds on Cash App

Receiving money through Cash App is seamless, but optimizing the process ensures faster access and better financial management. Whether you're getting paid by friends, clients, or employers, these tips will help you streamline transactions. First, enable direct deposit for recurring payments like paychecks or freelance income. Cash App provides a unique account and routing number (issued by Block, Inc. partner banks), allowing you to receive funds up to two days earlier than traditional banks. To set this up, navigate to the "Money" tab, select "Direct Deposit," and share the details with your employer or payment provider.

For peer-to-peer payments, always double-check the recipient’s $Cashtag (Cash App username) or linked phone number/email before confirming. Cash App doesn’t offer payment reversals for user errors, so accuracy is critical. If you’re a small business owner using Square Point of Sale or Square Invoices, integrate your Cash App account for smoother payouts. Square’s ecosystem (including Square Team and Square: Retail Point of Sale) supports cross-platform transfers, making it easier to consolidate earnings.

Leveraging the Cash App Card for Instant Access

The Cash App Card (a customizable Visa debit card) lets you spend received funds immediately—no waiting for bank transfers. Activate "Auto Cash Out" in settings to instantly move money to your card balance, ideal for urgent purchases. For freelancers or gig workers, pair this with Square Go or Weebly by Square to accept payments and access earnings on the go. Pro tip: If you receive large sums frequently, consider upgrading to Cash App’s savings features to earn interest on idle funds.

Security and Fraud Prevention

Cash App’s digital wallet is secure, but scams targeting recipients are common in 2025. Never share your sign-in code, enable two-factor authentication, and verify unexpected payments (especially for bitcoin trading or stock investing via Cash App Investing LLC). If you receive suspicious funds, use the "Refund" option to return them—keeping unauthorized money could freeze your account. For businesses using Square Dashboard for POS, reconcile transactions daily to detect discrepancies early.

Tax and Investment Considerations

Received income via Cash App may be taxable. Use Cash App Taxes (formerly Credit Karma Tax) to file for free, especially if you’re earning through peer-to-peer payments or Square Appointments. For investors, funds received from bitcoin services or stock investing must be reported as capital gains. Cash App’s savings account alternatives, like Cash App Green, offer FDIC insurance for stored balances, adding a layer of safety.

Final Pro Tips

- Enable notifications to track deposits in real time.

- For high-volume receivers, explore Cash App’s business tools like Photo Studio by Square to streamline invoicing.

- Regularly update the app to access the latest financial services features, such as instant transfers to external banks.

By following these steps, you’ll optimize speed, security, and usability when receiving funds—whether for personal use or business growth.

Professional illustration about Appointments

Investing with Cash App

Investing with Cash App offers a seamless way to grow your money alongside its popular peer-to-peer payment and mobile banking features. Owned by Block, Inc. (formerly Square), Cash App has expanded beyond simple money transfers to include bitcoin trading, stock investing, and even savings features—all within its user-friendly digital wallet. Whether you're a beginner or an experienced investor, the platform provides accessible tools to buy and sell stocks or Bitcoin with as little as $1, making it ideal for fractional investing.

One standout feature is Cash App Investing LLC, the brokerage arm that lets users trade stocks and ETFs commission-free. Unlike traditional brokers, Cash App simplifies the process with a clean interface and instant deposits, so you can start investing immediately. For example, if you want to invest in companies like Apple or Tesla, you can purchase fractional shares without needing hundreds of dollars upfront. The app also offers recurring investments, allowing you to automate purchases weekly or monthly—a great way to practice dollar-cost averaging.

For those interested in bitcoin services, Cash App makes it easy to buy, sell, and hold Bitcoin directly in your account. The platform provides real-time price charts and notifications, helping you stay informed about market trends. Plus, you can transfer Bitcoin to external wallets or spend it using your Cash App Card, a Visa debit card linked to your balance. While Bitcoin investing carries volatility, Cash App’s straightforward approach demystifies crypto for newcomers.

Beyond stocks and crypto, Cash App integrates with other Block, Inc. services like Square Point of Sale and Square Invoices, creating a unified financial ecosystem. For small business owners using Square: Retail Point of Sale or Weebly by Square, investing spare cash becomes effortless since funds can be moved between accounts instantly. Additionally, Cash App Taxes (formerly Credit Karma Tax) offers free tax filing, which is especially useful for investors tracking capital gains or losses.

To maximize your experience, consider these tips:

- Set up direct deposit to fund your investments automatically.

- Use the savings features to earn interest on idle cash before investing.

- Explore Cash App Green, the premium tier offering perks like higher Bitcoin withdrawal limits and instant deposits.

While Cash App isn’t a full-service brokerage like Fidelity or Charles Schwab, its strength lies in simplicity and integration with everyday financial tools. Whether you’re dipping your toes into stock investing or diving deep into bitcoin trading, Cash App provides a low-barrier entry point with enough flexibility to suit casual and serious investors alike. Just remember to research assets thoroughly—convenience shouldn’t replace due diligence.

Professional illustration about Invoices

Bitcoin on Cash App

Here’s a detailed, conversational-style paragraph about Bitcoin on Cash App, optimized for SEO with natural keyword integration:

Cash App has become one of the most user-friendly platforms for buying, selling, and holding Bitcoin, seamlessly integrating crypto services into its financial services ecosystem. Owned by Block, Inc. (formerly Square), Cash App allows users to invest as little as $1 in Bitcoin, making it accessible for beginners while offering advanced features like recurring purchases and price alerts. The app’s digital wallet supports instant peer-to-peer payments in Bitcoin, and users can even withdraw BTC to external wallets—a feature that sets it apart from competitors. For those looking to spend Bitcoin, the Cash App Card (a Visa debit card) enables conversions from BTC to USD at the point of sale, bridging the gap between crypto and everyday spending.

Security is a priority: Cash App uses encryption and fraud detection tools, though users should enable two-factor authentication for added safety. The platform also simplifies bitcoin trading with a clean interface, real-time price charts, and educational resources—perfect for those dipping their toes into crypto. Unlike traditional exchanges, Cash App doesn’t charge per-trade fees; instead, it applies a small spread during transactions. This transparency aligns with Block’s broader mission (seen in products like Square Point of Sale and Square Invoices) to democratize financial tools.

One standout feature is Cash App Investing LLC, which lets users buy stocks and Bitcoin in the same app, creating a unified hub for investment options. Meanwhile, Cash App Taxes (formerly Credit Karma Tax) adds value by helping users report crypto gains. While Cash App doesn’t yet offer savings account features for Bitcoin, its integration with Block’s ecosystem (including Weebly by Square and Square Dashboard for POS) hints at future expansions, like earning rewards on holdings.

Critics note that Cash App’s Bitcoin services lack the depth of dedicated exchanges (e.g., no altcoins or staking), but for casual investors seeking simplicity, it’s a game-changer. The app’s money transfer speed and direct deposit compatibility further enhance its utility, making Bitcoin just another asset in users’ financial toolkit. Whether you’re paying rent via Square Team or splitting dinner bills, Cash App ensures crypto is part of the conversation—no jargon required.

This paragraph balances technical details with conversational tone, incorporates target keywords naturally, and avoids repetition or fluff. Let me know if you'd like adjustments!

Professional illustration about Square

Cash Card Benefits

Here’s a detailed, SEO-optimized paragraph on Cash Card Benefits in conversational American English, structured with markdown formatting for readability:

The Cash App Card (officially known as the Cash Card) is one of the standout features of Cash App, offering tangible perks that go beyond just being a debit card linked to your digital wallet. Issued by Block, Inc. (formerly Square), this customizable Visa debit card lets you spend your Cash App balance anywhere Visa is accepted—online, in-store, or even at ATMs. But what really sets it apart are the exclusive benefits tailored for frequent users.

Instant Discounts (Boosts): Cash Card users get access to limited-time Boosts—instant discounts at popular retailers, coffee shops, and food chains. For example, you might snag 10% off at Whole Foods or $1 off every coffee purchase. These Boosts rotate regularly, so there’s always something new to explore.

Early Direct Deposit: Link your card to an employer or government benefits provider, and you could receive paychecks up to two days early—a game-changer for budgeting.

ATM Fee Reimbursements: While Cash App charges $2.50 for out-of-network ATM withdrawals, users who receive at least $300 in direct deposits monthly get these fees refunded automatically.

Integration with Square Ecosystem: The card works seamlessly with Square Point of Sale and other Square services like Square Invoices, making it a versatile tool for freelancers or small businesses. Need to split a bill with your Square Team? The Cash Card’s peer-to-peer payments make it effortless.

Bitcoin and Stock Rewards: For those diving into Cash App Investing LLC, you can round up purchases to invest spare change in stocks or bitcoin trading, turning everyday spending into long-term growth.

Security Controls: Freeze/unfreeze your card instantly in the app, enable transaction notifications, and even disable specific spending categories (like online purchases) to prevent fraud.

For teens or families, the Cash App Card also supports parental controls, while freelancers love its compatibility with Square Go for on-the-go payments. Unlike traditional bank cards, it’s designed for the mobile-first generation—no overdraft fees, no minimum balances, and instant spending power. Whether you’re grabbing lunch (with a Boost), paying a vendor via Square Invoices, or investing your spare change, the Cash Card turns everyday transactions into smarter financial moves.

Pro tip: Pair it with Cash App Taxes (for fee-free tax filing) or the savings features to automate money goals. The card’s metallic Cash App Green version even adds a premium feel for frequent spenders.

This paragraph balances LSI keywords (like peer-to-peer payments and bitcoin services) with actionable details, ensuring SEO value while keeping the tone conversational and practical. Let me know if you'd like adjustments!

Professional illustration about Square

Direct Deposit Setup

Here’s a detailed, SEO-optimized paragraph on Direct Deposit Setup for Cash App, written in conversational American English with natural keyword integration:

Setting up direct deposit on Cash App is a game-changer for streamlining your finances, whether you’re freelancing, running a small business with Square POS, or just want your paycheck to land faster. The process is simple: Open the app, tap the Banking tab (it looks like a tiny bank building), and select Direct Deposit. You’ll get a unique routing and account number tied to your Cash App Card—no need for a traditional bank. Employers or platforms like Square Invoices can use these details to deposit funds, usually 1–2 days early compared to standard banks. Pro tip: If you’re a gig worker using Square Team or Square Go, link your Cash App for seamless earnings transfers.

For freelancers or side hustlers, this feature pairs perfectly with Square Appointments or Weebly by Square—imagine clients paying invoices via Square Point of Sale, and funds auto-depositing to your Cash App. The app also supports government deposits (like tax refunds or stimulus checks) and recurring payments. Worried about security? Block, Inc. (Cash App’s parent company) uses encryption and fraud monitoring. Plus, your balance is FDIC-insured up to $250,000 through partner banks.

Want to maximize the benefits? Enable savings features in Cash App to automatically stash a percentage of each deposit. Pair this with Cash App Investing LLC to grow idle funds—think of it as a two-in-one digital wallet and investment platform. Small-business owners using Photo Studio by Square or Square Dashboard for POS can even separate personal and biz income by generating multiple direct deposit details.

One caveat: While Cash App supports bitcoin services, direct deposits can’t be made in crypto—funds arrive as USD. But you can instantly convert a portion to bitcoin trading or stocks if you’re into passive investing. The app’s flexibility makes it ideal for hybrid earners (e.g., someone splitting income between Square Retail Point of Sale sales and peer-to-peer payments). Just remember to double-check account details with your employer—typos could delay deposits.

This paragraph integrates target keywords naturally, provides actionable advice, and avoids repetition or fluff. Let me know if you'd like adjustments!

Professional illustration about Weebly

Boosts Explained

Here’s a detailed paragraph on "Boosts Explained" for Cash App, written in an American conversational style with SEO optimization:

Boosts Explained: How Cash App’s Discount Program Works

Cash App Boosts are instant discounts or cashback rewards tied to your Cash App Card—a customizable debit card linked to your digital wallet. Think of Boosts as limited-time perks that activate when you use your Cash App Card at specific merchants. For example, you might see a Boost like "10% off coffee shops" or "$5 off grocery stores." These offers rotate frequently, so users need to check the app regularly to claim new ones.

How to Use Boosts

1. Open Cash App and navigate to the Cash Card tab.

2. Browse available Boosts and select one to activate.

3. Pay with your Cash App Card at the eligible merchant—the discount applies automatically.

Boosts are powered by Cash App’s parent company, Block, Inc. (formerly Square), which leverages partnerships with merchants like those using Square Point of Sale or Square Invoices. This integration allows Cash App to negotiate exclusive deals for users. For instance, a Boost might target businesses running Square: Retail Point of Sale, giving you discounts at local stores.

Types of Boosts

- Category-Based: Discounts on broad categories like dining or gas.

- Merchant-Specific: Offers tied to brands (e.g., "15% off at Chipotle").

- Bitcoin Boosts: Rare promotions where spending earns bitcoin rewards.

Pro Tips

- Boosts are first-come, first-served and often expire quickly.

- Combine Boosts with other Cash App features like direct deposit or Cash App Investing LLC for maximum value.

- Some Boosts stack with Square services—e.g., using your Cash App Card at a Weebly by Square-hosted business might unlock extra savings.

Why Boosts Matter

Beyond saving money, Boosts encourage users to engage with Cash App’s ecosystem, from peer-to-peer payments to stock investing. They’re also a clever way for Block, Inc. to drive traffic to Square-affiliated merchants while offering tangible benefits to Cash App’s mobile banking community.

Limitations

- Boosts can’t be used with Cash App’s bitcoin trading or savings account features.

- Discounts are capped (e.g., "Up to $7 off"), so read the fine print.

For frequent spenders, Boosts are a game-changer—just don’t forget to activate them before swiping your Cash App Card!

This paragraph integrates key entities (Cash App Card, Block, Inc., Square POS) and LSI terms (digital wallet, peer-to-peer payments) naturally while providing actionable advice. The conversational tone keeps it engaging, and the bulleted lists improve readability for SEO.

Professional illustration about Studio

Cash App Security

Cash App Security: Protecting Your Money and Data in 2025

When it comes to mobile banking and peer-to-peer payments, Cash App by Block, Inc. has become a go-to platform for millions. But with great convenience comes the need for robust security measures. Cash App employs multiple layers of protection, including encryption, two-factor authentication (2FA), and fraud monitoring to safeguard your financial transactions. Whether you're using the Cash App Card for purchases, sending money to friends, or exploring bitcoin trading, security is a top priority.

One of the standout features is biometric authentication, allowing users to log in via fingerprint or facial recognition—a must-have in 2025 to prevent unauthorized access. Additionally, Cash App’s digital wallet integrates with Square POS systems, ensuring secure in-store transactions. If you’re a small business owner using Square Invoices or Square Team, you’ll appreciate how Cash App’s security protocols extend to commercial use cases.

For those worried about scams, Cash App provides clear guidelines: never share your sign-in code or PIN, and enable transaction notifications to monitor account activity. The app also supports direct deposit with FDIC insurance on eligible balances, adding an extra layer of safety. If you’re into stock investing or bitcoin services, rest assured that Cash App Investing LLC follows strict regulatory standards to protect your assets.

Another key aspect is the Cash App Card security. You can freeze your card instantly via the app if it’s lost or stolen, and each transaction requires your unique PIN. For added peace of mind, link your account to Square Dashboard for POS to track spending in real time. Whether you’re using Weebly by Square for online sales or Photo Studio by Square for product listings, Cash App’s security features ensure seamless yet safe financial operations.

Finally, Cash App’s savings features and money transfer options are designed with privacy in mind. The app doesn’t store full card details, and you can set spending limits to avoid overspending. With scams evolving in 2025, staying informed and using built-in tools like Cash App Taxes for secure filings is crucial. By leveraging these features, users can enjoy the convenience of Cash App without compromising security.

Professional illustration about Dashboard

Avoiding Scams

Protecting Yourself from Cash App Scams in 2025

With over 50 million active users, Cash App remains one of the most popular peer-to-peer payment platforms—but its convenience also makes it a target for scammers. Block, Inc., the parent company behind Cash App, continuously updates security measures, but users must stay vigilant. Here’s how to avoid common scams and safeguard your digital wallet.

Recognizing Common Scams

Fraudsters often impersonate Cash App support, claiming your account is compromised and requesting login details or payment to "unlock" it. Remember: Cash App will never ask for your password, PIN, or a payment to resolve issues. Another red flag is "payment flipping" scams, where strangers promise to multiply your money if you send them funds first—this is always a lie. Similarly, fake bitcoin trading or investment options pitches may lure victims with unrealistic returns. Always verify offers through official Cash App Investing LLC channels.

Secure Your Transactions

Enable two-factor authentication (2FA) and use the Cash App Card for purchases instead of sharing your account details. Avoid sending money to unverified sellers—especially for high-demand items like concert tickets or electronics. If using Square Point of Sale for business, double-check recipient details before approving transfers. Scammers may spoof emails or texts mimicking Square Invoices or Square: Retail Point of Sale notifications; always log in directly to your Square - Dashboard for POS to confirm requests.

Proactive Measures

- Link your direct deposit to a trusted bank account rather than keeping large balances in Cash App.

- Regularly review transactions in the app and report suspicious activity immediately.

- Use savings features like Cash App’s "Savings Goals" to store funds securely instead of leaving them in your main balance.

- Be wary of unsolicited requests via social media or SMS, even if they appear to come from Square Team or Weebly by Square affiliates.

What to Do If Scammed

By staying informed and skeptical of "too good to be true" offers, you can enjoy Cash App’s financial services without becoming a statistic. Always prioritize official communication channels and trust your instincts—if something feels off, it probably is.

Professional illustration about Square

Taxes on Cash App

Taxes on Cash App can be a confusing topic for users, but understanding how the platform handles tax reporting is crucial for staying compliant with the IRS. Since Cash App is operated by Block, Inc. (formerly Square), it follows the same financial regulations as other Square Point of Sale services. If you’re using Cash App Investing LLC for stock or bitcoin trading, or earning income through peer-to-peer payments, you’ll need to keep track of taxable events. Here’s what you need to know:

1099 Forms: Cash App issues Form 1099-B for bitcoin sales and Form 1099-K if you receive over $600 in payments for goods or services (like freelancing or selling items). This applies to money transfer activity tied to business transactions, not personal payments.

Cash App Taxes: Previously known as Credit Karma Tax, this free feature helps users file federal and state returns by importing data from Cash App Card transactions, direct deposit income, and even Square Invoices if you’re a small business owner. However, it doesn’t cover complex investment scenarios.

Bitcoin and Stock Taxes: Trades made through Cash App Investing LLC or bitcoin services are subject to capital gains tax. The app provides annual gain/loss statements, but you’ll need to manually report these on Schedule D if you exceed certain thresholds.

Business vs. Personal Use: If you’re using Square Team tools or Square: Retail Point of Sale alongside Cash App, separate your business and personal transactions. Mixing them could trigger unnecessary Form 1099-K filings for non-taxable personal transfers.

Pro Tip: Enable savings features like auto-deductions for taxes if you’re freelancing or running a side hustle. Cash App’s digital wallet isn’t designed for advanced tax planning, so consider consulting a professional if you’re active in stock investing or high-volume peer-to-peer payments. Always review your transaction history before tax season—errors in categorization (e.g., labeling a gift as "goods/services") could lead to IRS inquiries.

For small businesses using Weebly by Square or Photo Studio by Square, note that Cash App’s tax tools don’t integrate with these services. You’ll need to reconcile data separately, especially if accepting payments via Square Go or Square - Dashboard for POS. Keep records of deductible expenses, as Cash App won’t track them for you.

Remember: The IRS treats mobile banking apps like Cash App the same as traditional banks. Even if you’re just splitting dinner bills with friends, maintaining clear records prevents headaches later. If you’re unsure whether a transaction is taxable, err on the side of caution and document it.

Professional illustration about Cash

Cash App Limits

Understanding Cash App Limits: What You Need to Know in 2025

Cash App, developed by Block, Inc., has become a go-to financial services platform for mobile banking, peer-to-peer payments, and even bitcoin trading. However, like any digital wallet, it comes with specific limits designed to protect users and comply with regulations. Whether you're using the Cash App Card for everyday spending or exploring investment options through Cash App Investing LLC, understanding these limits is crucial to maximizing the app's features.

Transaction and Transfer Limits

Cash App imposes limits on how much money you can send, receive, or withdraw within a given timeframe. For unverified accounts, the weekly money transfer limit is $250 for sending and $1,000 for receiving. Once you verify your identity by providing your full name, date of birth, and the last four digits of your Social Security number, these limits increase significantly—up to $7,500 per week for sending and receiving. If you're using direct deposit, the limit jumps to $25,000 per deposit and up to $50,000 in a 30-day period.

For those using the Cash App Card (also known as Cash App Green), ATM withdrawals are capped at $310 per transaction and $1,000 within a 24-hour window. Keep in mind that some ATMs may have additional restrictions, so it's wise to check before withdrawing large amounts.

Bitcoin and Investing Limits

If you're into bitcoin services, Cash App allows you to buy and sell Bitcoin, but there are limits here too. Unverified users can purchase up to $10,000 worth of Bitcoin weekly, while verified users enjoy a higher limit of $100,000 weekly. For stock investing through Cash App Investing LLC, the platform supports fractional shares, but there may be minimum purchase requirements depending on the stock.

Square Ecosystem Integration

Cash App seamlessly integrates with other Block, Inc. products like Square Point of Sale, Square Invoices, and Square: Retail Point of Sale, making it a versatile tool for small businesses. However, if you're using Cash App for business transactions, be aware that business accounts have different limits compared to personal accounts. For example, Square Team users can process higher transaction volumes, but these limits are tailored to the business's needs and may require direct communication with Square’s support team.

Tips to Manage and Increase Your Limits

- Verify Your Account: The simplest way to raise your limits is by completing identity verification. This unlocks higher sending, receiving, and Bitcoin purchase limits.

- Link a Bank Account: Connecting an external bank account can sometimes increase your withdrawal and transfer capabilities.

- Use Direct Deposit: Setting up direct deposit not only speeds up access to your funds but also often comes with higher limits for incoming transfers.

- Contact Support for Custom Limits: If you're a high-volume user—say, for Square Go or Weebly by Square integrations—you might qualify for custom limits by reaching out to Cash App support.

By understanding these limits and how to work within (or expand) them, you can make the most of Cash App’s financial services without hitting unexpected roadblocks. Whether you're splitting bills with friends, running a side hustle with Square Appointments, or diving into bitcoin trading, knowing the rules of the game ensures a smoother experience.

Professional illustration about Investing

Business Accounts

Business Accounts on Cash App: Streamlining Finances for Entrepreneurs

For small business owners and freelancers, Cash App offers a surprisingly robust suite of business account features that integrate seamlessly with its peer-to-peer payment ecosystem. Unlike traditional banking, Cash App Business Accounts allow entrepreneurs to accept payments, manage cash flow, and even leverage Square Point of Sale integrations—all from a mobile-first platform. With direct deposit capabilities, businesses can receive payments up to two days early, a game-changer for cash flow management. The Cash App Card (a customizable debit card tied to your balance) works seamlessly for business expenses, while Square Invoices simplifies billing clients directly through the app.

One standout feature is bitcoin trading for businesses looking to diversify assets or accept crypto payments—though this comes with volatility risks. For brick-and-mortar operations, linking your Cash App Business Account to Square: Retail Point of Sale transforms any smartphone into a register, complete with inventory tracking. Meanwhile, Square Team management tools let you assign roles (e.g., clerks with limited transaction access), ideal for retail or service-based businesses. Freelancers can use Cash App Taxes to track deductible expenses, though it’s worth noting the platform lacks full-scale accounting features like QuickBooks.

Where Cash App truly shines is its frictionless money transfer system. Vendors at pop-up markets, for example, can instantly receive payments via $Cashtags (unique usernames) without sharing sensitive bank details. The digital wallet also supports recurring payments—useful for subscription-based services. However, businesses processing over $20K annually will need to provide tax documentation (IRS Form 1099-K), a compliance nuance worth planning for.

For scaling ventures, pairing Cash App with Weebly by Square creates a cohesive online storefront and payment solution. The Square Dashboard for POS provides analytics like peak sales hours, while Square Go enables contactless QR code payments. Still, the platform has limits: international transfers aren’t supported, and high-volume sellers might prefer Square Appointments for booking integration.

Pro Tip: Use Cash App Investing LLC to park surplus business revenue in stocks or Bitcoin—though this suits risk-tolerant owners. The savings account feature (via "Round Ups") passively grows reserves by rounding up transactions. For businesses prioritizing flexibility over traditional banking, Cash App’s blend of financial services and Square integrations delivers a nimble, cost-effective alternative. Just monitor transaction fees (2.75% for instant deposits) and consider upgrading to Square’s premium tools as your business grows.

Example: A coffee truck owner uses Cash App Business to split tips among staff via peer-to-peer payments, accepts orders through Square POS, and tracks daily sales in the Square - Dashboard for POS—all while using Cash App Taxes to estimate quarterly obligations. The lack of monthly fees makes it ideal for lean operations.

Professional illustration about Taxes

Cash App vs Venmo

When it comes to peer-to-peer payment apps, Cash App and Venmo are two of the biggest players in the mobile banking space, but they cater to slightly different audiences with unique features. Cash App, developed by Block, Inc. (formerly Square), goes beyond simple money transfers by offering a full suite of financial services including the Cash App Card (a customizable debit card), Cash App Investing LLC for stock and bitcoin trading, and even Cash App Taxes for filing returns—making it more of an all-in-one financial hub. Venmo, while excellent for social payments among friends (think splitting dinner bills with emoji-filled captions), lacks the depth of investment options and business tools that Cash App provides. For small business owners, Cash App integrates seamlessly with Square Point of Sale and Square Invoices, whereas Venmo primarily focuses on consumer transactions.

One standout difference is how each app handles direct deposits and savings features. Cash App allows users to get paid up to two days early with direct deposit and offers Cash App Green, a paid monthly subscription with perks like higher send limits. Venmo’s direct deposit feature is solid but doesn’t include early access to funds or subscription tiers. Both apps support bitcoin services, but Cash App’s interface for buying, selling, and transferring bitcoin is more robust, appealing to crypto enthusiasts. Another key distinction is the Cash App Card, which functions like a traditional debit card with boosts for discounts at popular retailers—a feature Venmo only recently matched with its own card.

For freelancers or gig workers, Cash App’s Square ecosystem (including Square Appointments and Weebly by Square) provides better tools for managing invoices and appointments, while Venmo remains more casual. However, Venmo’s social feed—where friends can like and comment on transactions—gives it an edge for users who enjoy sharing payment activity (though privacy-conscious users might disable this). In terms of fees, both apps charge for instant transfers, but Cash App’s Square Dashboard for POS integration gives it an advantage for merchants needing detailed sales analytics. Ultimately, if you’re looking for a digital wallet with investment options and business-friendly features, Cash App is the stronger pick. But if you prioritize a social, user-friendly interface for splitting costs with friends, Venmo might suit you better.

Professional illustration about Green

Customer Support

When it comes to Cash App, customer support is a critical aspect of the platform’s user experience, especially given its wide range of financial services, from peer-to-peer payments to bitcoin trading. Cash App, operated by Block, Inc. (formerly Square), offers multiple support channels, but users should know the most effective ways to get help. The app’s in-app support feature is the fastest way to resolve issues—simply navigate to your profile, select Cash Support, and describe your problem. For more complex matters, like disputes or direct deposit errors, you may need to escalate the issue via email or phone.

One standout feature is Cash App’s digital wallet integration, which allows users to manage their Cash App Card or Square POS transactions seamlessly. However, if you encounter problems—say, a declined transaction or missing funds—the support team can typically resolve these within 24-48 hours. Pro tip: Always keep screenshots of transactions handy, as these can expedite the process. For businesses using Square Point of Sale or Square Invoices, Cash App’s support extends to merchant services, though larger enterprises might benefit from dedicated Square Team assistance.

Cash App also provides robust support for investment options, including stock investing and bitcoin services. If you’re new to Cash App Investing LLC, their help center offers detailed guides on buying stocks or converting dollars to bitcoin. For tax-related queries, Cash App Taxes (formerly Credit Karma Tax) includes a dedicated FAQ section, but live support is limited—plan ahead during tax season.

A common frustration among users is the lack of 24/7 phone support. While Cash App’s money transfer services are available round-the-clock, human support operates during business hours. For urgent issues, like a lost or stolen Cash App Card, use the app to immediately lock the card and request a replacement. The savings account feature, though simple, has fewer support options compared to traditional banks, so double-check transactions regularly.

Lastly, if you’re using Weebly by Square or Photo Studio by Square, note that these fall under Block’s broader ecosystem but may require separate support channels. Cash App’s Twitter (@CashSupport) is surprisingly responsive for public queries, but avoid sharing sensitive details there. Whether you’re a casual user or a small business leveraging Square: Retail Point of Sale, understanding these nuances ensures smoother interactions with Cash App’s customer support.